Metro Scorecard Results - June 2025

The US labor market continues to post positive year-over-year job growth, despite headwinds from current and potential tariffs, continued high interest rates, and concerns about consumer strength. Still, recently released month-to-month seasonal data for the US shows a slower-growth Q2 than previously estimated.

According to the US Bureau of Labor Statistics (BLS), the national economy posted year-over-year* job growth of 1.0% in June. Growth rates were highest for Health Services & Education (3.3%)**, Leisure & Hospitality (1.3%), and Construction (1.2%). Most new jobs are being created in three large sectors: Health Services & Education, Government, and Leisure & Hospitality. Notably, Manufacturing shrank the most on a percentage basis (-0.8%).

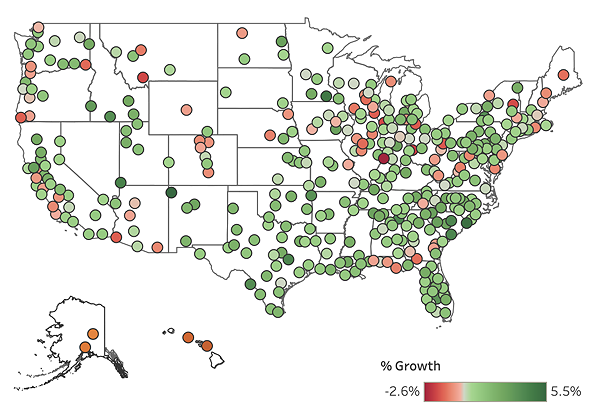

At the metro level, 303 metros grew in June versus June the previous year, while just 73 (19%) metros lost jobs. Small metros had a higher percentage that shrank (23%), with these metros clustering in the upper Midwest, upper Appalachia, and along the West Coast.

Small Metro Employment Growth

June 2024 vs. June 2025

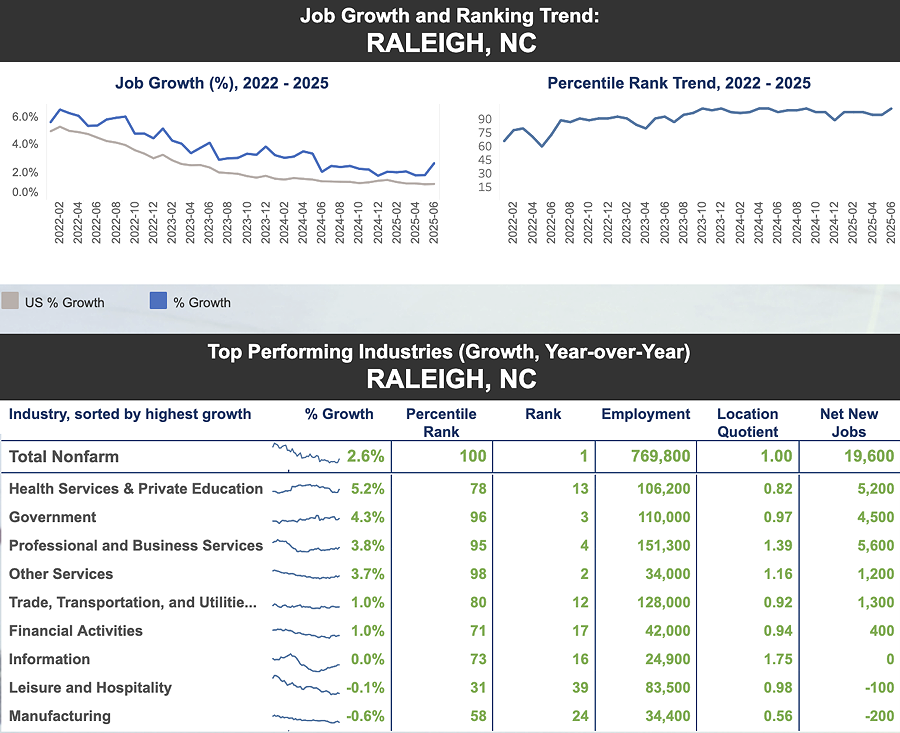

Top performers for large metros were Raleigh, Charlotte, and Salt Lake City. Medium-sized metro leaders were Charleston (SC), Fayetteville (AR), and Boise (ID). Small metro leaders were Farmington (NM), Myrtle Beach (SC), and Rochester (MN).

In our Economic Scorecard, we profile the top-performing metros by size and industry. And, communities can see their trend data versus the US and for individual industries as shown below:

* We prefer to use year-over-year (e.g. June '25 versus June '24), not month-to-month data that is seasonally adjusted so that we also gain industry-level data which is not available in seasonally adjusted data at the metro level.

** Education & Health Services includes private sector establishments only. Any government-owned establishments (e.g. public school and public hospitals) are categorized under Government.